Taking on Wall Street: Inside Peddie’s Student Investment Program

How Peddie students are managing real money and gaining unmatched financial experience.

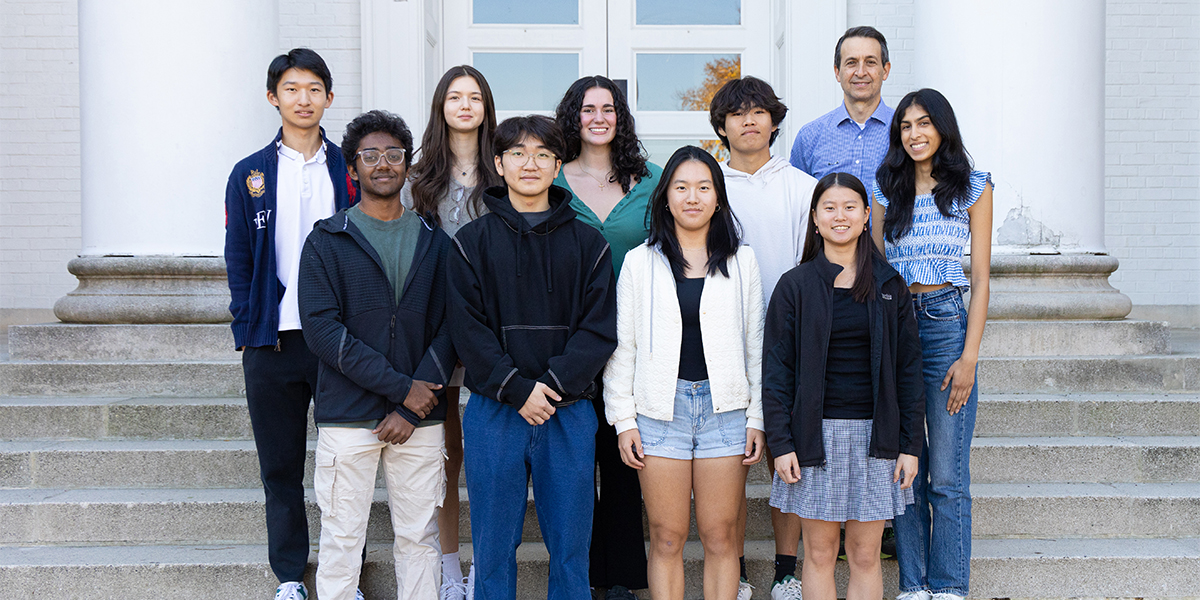

Nine Peddie students sit huddled around a table, engaged in an intense discussion. But they’re not debating literature or science — they’re deciding whether to invest thousands of dollars in a skincare company.

These students make up the Peddie School Student Investment Committee (PSSIC), one of the few high school programs in the country where students manage real money for the school’s endowment.

“It honestly feels so amazing that the school has put so much trust in us,” said Leena Mirchandani ’25, current president of PSSIC. “I think that says a lot about how much value the school places on their students and their education and growth.”

Launched in 2022 with a generous gift from Michael Armellino ’57 GP’19, the PSSIC offers students hands-on experience with investment management and financial analysis. Armellino was driven to support this initiative by a simple observation: “Even some of the brightest and most educated people I know lack a knowledge of even the basics of finance,” he said. “Financial markets are impersonal. They are influenced by micro and macro events around the world every day. Connecting these events to financial decisions teaches critical and dynamic thinking.”

What truly sets the PSSIC apart is its presence at the high school level and the autonomy given to students to make decisions. “The students run this,” said faculty advisor Imad Labban. “They make the decisions. They do the research. My job is to make sure they don’t cross the street without looking both ways.”

Prior to his teaching career, Labban spent years on Wall Street, serving as managing director at Barclays Capital and Lehman Brothers. His deep experience in investment banking brings a level of mentorship to the program that is rare in a high school setting, giving students a unique opportunity to learn from someone who has navigated the complexities of financial markets.

This autonomy, combined with Labban’s expert guidance, has translated into strong performance. “If you look at our risk parameters relative to the markets, ours is a lot lower, and we’re still matching, if not beating, the market by a little,” Labban said.

The nine-member committee, composed of sophomores, juniors and seniors, follows a structured investment process. During the fall, they conduct research and analysis. In the winter, they vote on investments, and the rest of the year is spent refining strategies and connecting with alumni for advice and insight.

The diversity of the committee’s members is one of its strengths. “We’re not looking for nine people with extensive finance and investment backgrounds,” Mirchandani explained. “We’re looking for people well versed in different aspects of the school or who know about certain niche topics or interests.”

This broad range of perspectives has led to creative investment choices, such as last year’s investment in e.l.f. Beauty, informed by students’ awareness of trends in skincare and cosmetics.

The students’ commitment is notable. Even on school holidays, like Martin Luther King Day, they gather for marathon investment sessions. “Everybody kind of knows now, Martin Luther King Day, that’s a day of work for us,” Labban noted.

The impact of the program extends beyond learning about stocks and bonds. Students sharpen their critical thinking, improve their research skills and gain experience in professional debates and decision-making. They also benefit from networking opportunities, including direct access to alumni in finance.

One of those alumni is Armellino himself, who stays engaged with the group. “He makes an effort to meet with us. He really values our opinion,” said Mirchandani.

Now in its third year, the program’s success is evident – not just in investment performance, but in the personal growth of its members. Alumni of the program continue to stay involved, tracking the stocks they selected and mentoring current students, ensuring the program’s influence lasts far beyond graduation.